Written by Virginia Robertson

The future “atom bomb” of crypto is not, in my opinion, that terrorists will use crypto and other bad actors will use privacy platforms to move money.

I use the reference “atom bomb” because I believe that the original scientists and inventors who split atoms may not have had war games in mind. Nuclear technology can be used for good, for energy, but bad actors can always harness these things.

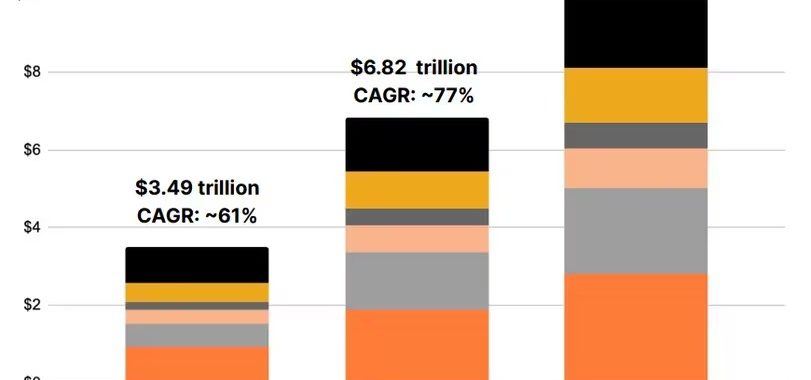

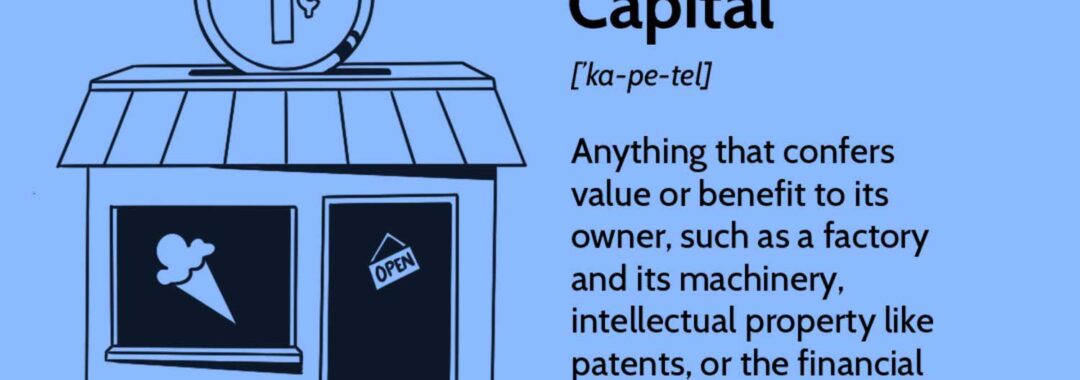

Starting from the beginning, it is most evident that business inventory assets will soon be moved to the blockchain. Yes, these assets can be traded, but my focus is how these assets can be capitalized for business credit directly on the blockchain and by banks. The financial sector has some catching up to do first. Banks, partnering with companies like Vaultlink, can manage crypto for their customers, and can use crypto rails like Ethereum to move funds quickly, reliably, and securely. But next up on their agenda will be to partner with businesses to tokenize their assets to secure business loans. Using new valuation technology like Item Banc, based on comparables, these real world asset inventories (the industry’s RWA lingo) can be used as leverage for loans.

The opportunity to tokenize business inventories is as powerful as new nuclear energy. It is the essence of the process of capitalization, which as the greatest economist (IMO), Hernando DeSoto indicated, was the reason that the “first world” stepped ahead of other developing economies.

The bad actors of crypto, like scavengers, may end up to be our own governments. The governments tax whatever capital they are aware of. Businesses will give to Caesar what is Caesar’s, and this can be acceptable, except for the fine-tuned instrument of Valuation. I have capitalized “Valuation”, as I do in my book, The Language of Value, because this is the critical piece that may determine whether the new capitalization brings war or peace.

Will we capitalize the Value of business inventories based on the dollars that governments force as tender? These dollars continue to be inflated to pay years of central bankers slight of hand at interest rate hacks.

In my opinion, the peaceful solution to our new amazing blockchain technologies that will lead to the capitalization of products and services is to make a new base of Value. We can make a base of Value by commoditizing a set of basic human needs used around the world. From this we can create Value to currencies, not the other way around. Peace can arise from the simple formulas of purchasing power parity. Lets use our technologies for good.