July 14th, 2024 Written by Jordan Gitterman

The Real World Asset (RWA) tokenization sector is still in its early stages but it has been gaining momentum in recent years and exponentially so in the past few months. The market has seen the tokenization of various tangible assets, including commodities, fine art, and real estate. In the last couple of months, many traditional financial instruments such as stocks and bonds have been tokenized. Use cases include lending, borrowing, swapping, staking, and fractionalizing assets, such as art and real estate.

The involvement of big names such as Bank of America, Citi Group, HSBC, Franklin Templeton, Microsoft and Vanguard who have announced or have brought projects to the market tokenizing industrial assets and securities, respectively, demonstrates the growing adoption of asset tokenization in the enterprise sector. The world’s largest asset manager BlackRock’s BUIDL token, which U.S. Treasuries back, has surpassed $500 million in market capitalization in just four months time. Blackrock also recently announced plans to tokenize the stock market. These lofty developments have emboldened more asset management firms to tokenize their assets.

Current Market Size

According to McKinsey, Inc the RWA Tokenization sector’s market capitalization was 1.8 billion dollars in 2018 with the current capitalization market estimated to be over $6 billion. In June 2024 Cointelgraph estimated RWA Tokenization’s market capitalization to be 8 billion. The tokenized gold market has captured over $1 billion in investment, and the combined market capitalization of tokenized money market funds is nearing $500 million. The market capitalization of commodity-backed tokens has surpassed $1.1 billion, as reported by CoinGecko’s RWA Report 2024.

The space is starting to disrupt various industries, including gaming, energy, collectibles, and real estate, and is beginning to transform the existing financial infrastructure, increase efficiencies, reduce costs, and optimize supply chains. A report from McKinsey begins by stating that tokenized financial assets are moving from pilot to at-scale deployment. RWA.xyz indicates that the total value of tokenized treasuries as of July 4, 2024, is $1.79 billion rising over 216% in the last year. MakerDAO announced on July 11th they will invest $1 billion in tokenized U.S. Treasury offerings which will increase the tokenized treasuries market capitalization by another 55%.

Lynn Wang of BeinCrypto reports: DeFi (Decentralized Finance) platforms are leveraging RWA tokenization to connect to the established financial system. Hamilton, a startup specializing in real-world asset (RWA) tokenization, has announced the tokenization of the first US Treasury bills on Bitcoin layer-2 (L2) solutions, including Stacks, Core, and BoB.

This milestone signifies a major step towards integrating traditional finance with the Bitcoin ecosystem, enhancing the accessibility and tradability of stable, government-backed assets within decentralized finance (DeFi) networks.

Forecasted Growth

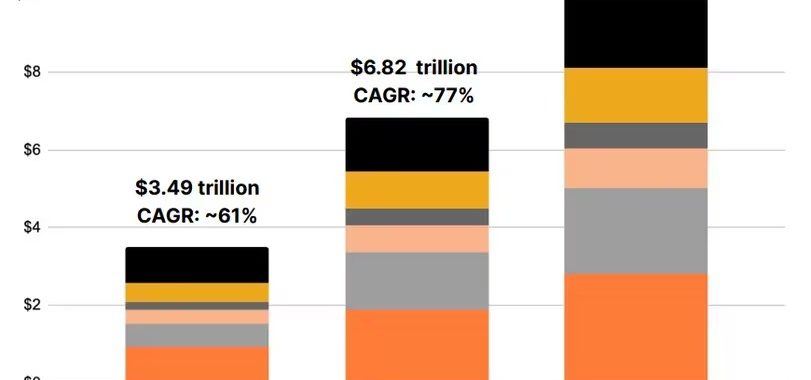

The potential for growth in the RWA tokenization sector is significant. Experts are forecasting trillions of dollars in tokenized digital-securities trade volume by 2030. Based on McKinsey’s analysis the total tokenized market capitalization should reach at least $2 trillion by 2030. They expect future growth this decade will be driven by adoption from mutual funds, lenders, issuers of bonds and exchange-traded notes (ETN), financial institutions and alternative funds. 21.co estimates that the market for tokenized assets could grow to $10 trillion in this decade as traditional financial institutions continue to adopt blockchain technology. Boston Consulting Group’s (BCG) prognosis of the RWA Tokenization market is $16 trillion by 2030. Standard and Charter’s projects that by 2034 the market will be 30 trillion with about 16% of it, 4.8 trillion dollars, from trade finance Other reports from large well known organizations forecast the RWA Tokenization sector’s market cap will be in the trillions of dollars.

Conclusion and Final Thoughts:

Now there are billions of dollars worth of financial assets being tokenized by marquee financial players. The increasing involvement of major financial institutions working on huge projects, such as BlackRock and Apollo Global Management, will help to legitimize and accelerate the adoption of real-world asset tokenization.

The growth of RWA tokenization projects and DeFi platforms incorporating these assets will continue to shape and merge the financial and digital landscape in the coming years. Trillions of dollars are slated to be directed to the tokenization of the financial markets.

What about all of the other markets? Mainstreet? Inventories, supply chains, etc, they too will be tokenized.

One can see the magnitude of this trend and conclude that it is paradigm-changing. Imagine the loss of “old” jobs and opportunities for “new ones”. When the supply chain and inventories are tokenized one will search a blockchain explorer rather than an internet explorer. How will RWA Tokenization affect how goods, services and money are exchanged?

The tokenization of real-world assets through the use of blockchain technology presents a clear path toward making numerous assets more valuable, accessible, and useful.

Currently, the most important topic regarding real-world asset tokenization is the increasing adoption and innovation in the field, particularly in the areas of asset-backed composability, interoperability and regulatory clarity. How well these areas are handled will answer our question of how many trillions of dollars will be deployed into RWA tokenization and how long will it take.