Written by: Jordan Gitterman.

The Real World Asset (RWA) tokenization sector is expanding exponentially and bridging the gap between physical and digital assets.

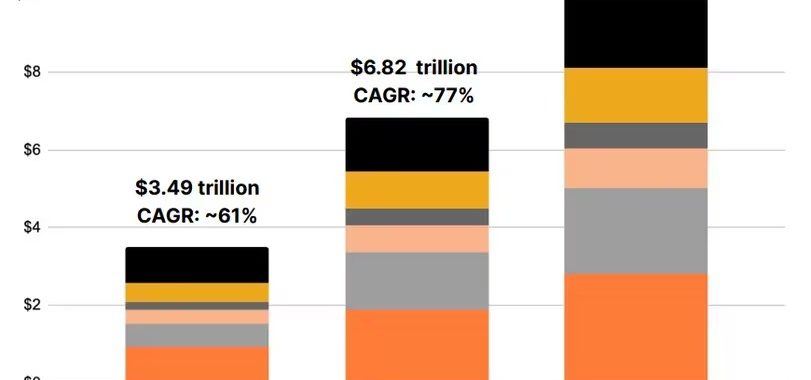

According to McKinsey, Inc., the RWA tokenization sector’s current market capitalization is estimated to be over $6 billion. McKinsey projects it to grow to at least $2 trillion by 2030. 21.co estimates that the market for tokenized assets could grow to $10 trillion in this decade. Boston Consulting Group’s (BCG) prognosis for the RWA tokenization market is $16 trillion by 2030, and Standard Chartered projects that by 2034 the market will be $30 trillion. The vast majority will be deployed in the tokenization of financial markets. There are many other markets, and efforts are being made to tokenize nearly everything.

Many financial professionals, including Larry Fink of BlackRock, state that everything of value will be tokenized. Citigroup said, “Almost anything of value can be tokenized and tokenization of financial and real-world assets could be the ‘killer use-case’ blockchain needs to drive a breakthrough.”

The market has seen the tokenization of various tangible assets, including commodities, fine art, and real estate. In the last couple of months, many traditional financial instruments such as stocks and bonds have been tokenized. Use cases include lending, borrowing, swapping, staking, and fractionalizing assets such as art and real estate. This phenomenon is transforming the financial markets by merging decentralized finance (DeFi) with traditional finance (TradFi).

Key Reasons Why Tokenization is Increasing:

- Increased Liquidity: Past studies estimated the share of illiquid assets at 20-30% of overall assets. Illiquid assets face challenges such as imperfect price discovery and trading discounts compared to liquid assets. The act of tokenization itself does not provide liquidity. Making assets discoverable and allowing fractional purchases of them are examples of qualities that tokenization provides, which lead to liquidity. Tokenization creates liquidity by making it easier for the assets to be distributed and traded among investors. Tokenization can allow for increased liquidity of traditionally illiquid assets, making it easier for investors to buy and sell these assets.

- Greater Accessibility: Tokenization can provide greater accessibility and ease of access for otherwise cloistered investment opportunities, allowing more people to participate in the market.

- Fractional Ownership: Tokenization enables fractional ownership, allowing investors to own a small portion of an asset, making it more accessible to a wider range of them.

- Transparency: Tokenization can increase transparency regarding ownership and ownership history, reducing the risk of fraud and corruption. Data management and governance are automated and transparent, ensuring accountability and trust.

- Security: Tokenization provides a transparent and tamper-proof record of ownership and transactions, enhancing trust and reducing the risk of fraud. Decentralized storage and smart contracts reduce the risk of data breaches, cyber-attacks, and censorship. Blockchain technology, where all token data is recorded and verified, provides a timestamped, secure, and immutable record.

- Immutable Record of Ownership: Tokenization provides an immutable permanent record of ownership, ensuring that all transactions are recorded and verified on a blockchain.

- Improved Risk Management: Tokenization provides a secure and transparent way to manage risk, allowing investors to make informed decisions.

- New Investment Opportunities: Tokenization can unlock new investment opportunities for individuals and institutions, allowing them to invest in assets that were previously inaccessible or illiquid.

- Broader Investor Base: Tokenization opens up new investment opportunities for a broader range of investors, including those who may not have had access to these assets previously.

- Increased Accessibility: Tokenization makes it possible for investors to access assets that were previously inaccessible due to high minimum investment requirements or other barriers.

- Interoperability and Composability: The development of interoperable tokenized assets and composability solutions is crucial for unlocking the full potential of asset tokenization, enabling the creation of complex financial instruments, and increasing liquidity. A highly composable system provides components that can be selected and assembled in various combinations to satisfy specific user requirements.

- Discoverability: Tokenized assets enter Web3, where all data is treated equitably, relieving one of the impediments of Web2, such as unfavorable algorithms, SEO rankings, and the necessity to advertise.

- Cost-Effective: Tokenization eliminates the need for intermediaries, reducing the costs associated with buying and selling assets and increasing efficiency.

- Efficiency: Automation of manual processes involved in bringing securities to public and private markets. The self-execution of contracts eliminates middlemen and reduces errors, leading to significant cost reductions.

- Easy to Invest: Tokenization provides a simple and easy way for investors to buy and sell assets, reducing the complexity and costs associated with investing.

- Data Sovereignty: Tokenization provides individuals and entities with the ability to have complete control over their data, deciding who can access and use it.

- Data Usage: Tokenizing data is a vehicle by which off-chain data can augment its utilization within the DeFi ecosystem.

- Monetization: Individuals can monetize their data through tokenization, generating revenue from its use and sharing.

- No Territorial Barriers: Tokenization allows investors to invest in assets located anywhere in the world, without the need for physical presence.

- Cost Savings: Tokenization can reduce administrative costs associated with traditional asset management, making it more attractive to investors and institutions.

- Collaboration and Partnerships: The formation of partnerships between industry players, such as Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks, is facilitating the development and growth of the real-world asset tokenization ecosystem.

- Regulatory Compliance: Ability to comply with industry standards and government regulations while minimizing cost and complexity.

- Private Blockchain Adoption: The adoption of private blockchain technology by institutions will enable the secure and efficient transfer of real-world assets onto the blockchain.

- New Asset Classes: Creation of new asset classes and investment opportunities.

- Real-World Asset Tokenization Platforms: The development of specialized platforms, such as Securitize, will provide a seamless and user-friendly experience for investors and institutions, making it easier to participate in the real-world asset tokenization market.

- Decentralized Storage: Web3 platforms utilize distributed ledger technology, such as blockchain, to store data in a decentralized manner. This means that data is not controlled by a single entity, reducing the risk of data breaches and censorship.

- Tokenized Data: Tokenization breaks down data into smaller, tradable units (tokens), allowing individuals to fractionalize and monetize their data. This empowers them to decide how their data is used and shared, as they can choose which tokens to sell or retain.

- Smart Contracts: Web3 smart contracts automate data management and governance, ensuring that data is processed and shared according to the individual’s predefined rules and permissions. This ensures transparency, accountability, and security.

- Innovation: Facilitated innovation through the composability of programmable contracts and shared ledgers.

- Decentralized Identity: Web3 enables individuals to create and manage their own digital identities, using tokens and decentralized storage to store and verify their personal data. This allows them to maintain control over their identity and data, and to share it selectively with trusted parties.

- Tokenized Market Growth: The growth of the tokenized market, as projected by the aforementioned and other top consulting firms, and by BCG & ADDX in their joint 2022 report, will create a self-sustaining cycle of demand and innovation, pushing real-world asset tokenization forward. They list five indications that asset tokenization may be on the cusp of wide global adoption, and each has been realized:

- Increased trading volume in tokenized assets

- Strengthening stakeholder sentiment across many countries

- Recognition among monetary authorities and regulators

- More asset classes being tokenized

- A growing pool of active developer talent in the blockchain space

Ultimately, the tokenization of everything is a transformation in data; how it is viewed, stored, transferred, and secured. Tokenization is a powerful technique that helps organizations and individuals securely disseminate sensitive data by replacing it with non-sensitive tokens.

This is a live document meant to be continuously edited, updated and revised. We welcome the community and readers to provide comments, critique, or inform if any positive attributes are missing so they can be added.

Thank you.